VBDO presents fourth Tax Transparency Benchmark

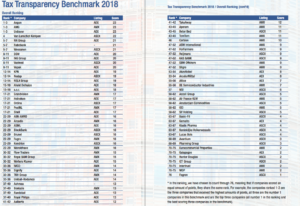

Dutch companies become more transparent about their tax policy. This is shown by research by the Association of Investors for Sustainable Development (VBDO) at 76 Dutch companies. The winner of the fourth Tax Transparency Award is Aegon. The company ended with AMG and Unilever at the top of the Tax Transparency Benchmark, which was presented 22 November at ABP in Amsterdam.

“We have seen transparency grow on this issue over the past five years. When we first asked questions on General Meetings of Shareholders in 2013, almost no company was talking about responsible tax. Now more than three-quarters publish on tax policy”, says Angélique Laskewitz, director of VBDO. The Dutch companies score on average 39 percent on the six ‘Good Tax Principles’ of VBDO and Oikos. This is higher than the 36 percent of last year.

Although companies become more transparent, they score – witness the average score of 39 percent – generally below par in the benchmark. This is due, for example, to companies giving insufficient security to stakeholders in the tax area. A few report to issue a ‘tax in-control’ statement and/or a validation by an external party. Companies also score poorly on the implementation of the tax strategy, and on the monitoring and testing of specific tax risks.

There is also something positive to mention, two-thirds of the businesses surveyed report that paying taxes is part of the corporate social responsibility. “VBDO expects companies to consider paying taxes as an integral part of their sustainability policy,” reports Angélique Laskewitz. VBDO calls on investors to include the results of the benchmark in engagement discussions.

Tax payment per country

Dutch companies hardly report according to country-by-country guidelines in public information. Reporting according to these guidelines makes it clear whether the business activities correspond with the tax payment in the given country. Companies can show in this way that they do not pursue aggressive tax structures or use so-called ‘tax havens’.

Aegon winner ‘Tax Transparency Award 2018’

Aegon is the first company in the financial sector to receive the ‘Tax Transparency Award’ at the Tax Transparency Seminar 2018 at ABP in Amsterdam. The jury praises Aegon for partially reporting country-by-country information. In addition, Aegon provides a detailed description of the implementation of the tax strategy. The jury emphasizes that Aegon scores higher than average on all six ‘Good Tax Principles’ and is therefore, the rightful winner of the ‘Tax Transparency Award 2018’.