Candriam invites you to join us in Amsterdam as we explore the power and potential of Sustainable Investing. Let’s come together to chart a course for a more sustainable future amidst these turbulent times. Programme Sustainable Investment Seminar 13:00 Welcome […]

Sign upSustainable investment

Dutch Insurers Show Unprecedented Alignment in Responsible Investment Benchmark, a.s.r. New Frontrunner

Publication: Benchmark on Responsible Investment by Insurance Companies in the Netherlands 2025 - Insuring our Future

Vincent Triesschijn on trends and developments in sustainable investing

NB. This article is part of our recent publication, the study guide Duurzaam beleggen door particulieren bij banken 2025 (available in Dutch only). Vincent Triesschijn is head of sustainable investing at ABN AMRO and is involved in integrating sustainability into investment […]

Read moreHadewych Kuiper on developments and trends in sustainable investing

NB. This article is part of our recent publication, the study guide Duurzaam beleggen door particulieren bij banken 2025 (available in Dutch only). Hadewych Kuiper has been Managing Director of Triodos Investment Management B.V., a wholly owned subsidiary of Triodos […]

Read moreSeminar Climate Engagement

NB. This event is supported by L&G, Asset Management. Climate change is not a distant threat; it is an urgent reality. Investors, companies and civil society all have a role to play in accelerating the transition to a low-carbon economy. […]

Sign upSeminar Responsible Investment by Dutch Insurers 2025

NB. This event is in Dutch. During this seminar, we will discuss the most important results from the Responsible Investment by Insurers benchmark 2025 and announce the winner of the Insurers Responsible Investment Award 2025. This year, special attention will […]

Deep dive webinar: Evaluating Mining Standards: Gaps, Challenges, and Opportunities

As the energy transition accelerates, ensuring strong environmental and social due diligence in mining is essential to achieving a just and responsible shift away from fossil fuels. This webinar provides a deep dive into key mining standards, including IRMA, IFC […]

Sign upItaSIF – The plastic crisis: how sustainable finance can drive change

In the last 20 years global output of plastic doubled, and most plastic waste was dumped into the environment. Plastic has huge impacts on marine biodiversity. Oil-producing countries opposed setting a plastic production reduction target at the late 2024 negotiation to put an end […]

Sign upTax Investor Guide 2025 (executive summary)

Publication: Tax: An Investor Guide

Tax transparency has become an essential aspect of responsible investment. The Dutch Association of Investors for Sustainable Development (VBDO) updates this guide to reflect the evolving regulatory landscape and the growing expectations of stakeholders regarding corporate tax practices. Institutional investors […]

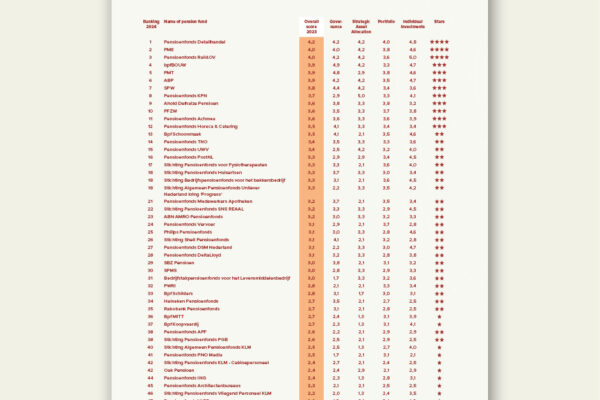

Read more DownloadRanking Dutch pension Funds Benchmark 2024

Publication: Ranking benchmark Responsible Investment by Pension Funds in the Netherlands 2024

VBDO Unveils Ambitious New Pension Fund Benchmark for 2024, Ranking Pension Fund Detailhandel as Top Performer in Responsible Investment

Publication: Benchmark on Responsible Investment by Pension Funds in the Netherlands 2024 - The journey towards a sustainable world

Biodiversity Credits: Last Step to Nature Restoration or False Solution?

Biodiversity conservation is essential, but the question of how companies should manage their impact on nature remains a contention. One of the options discussed is the purchase and sale of certificates, so-called biodiversity credits, similar to the voluntary carbon credits […]

Read more