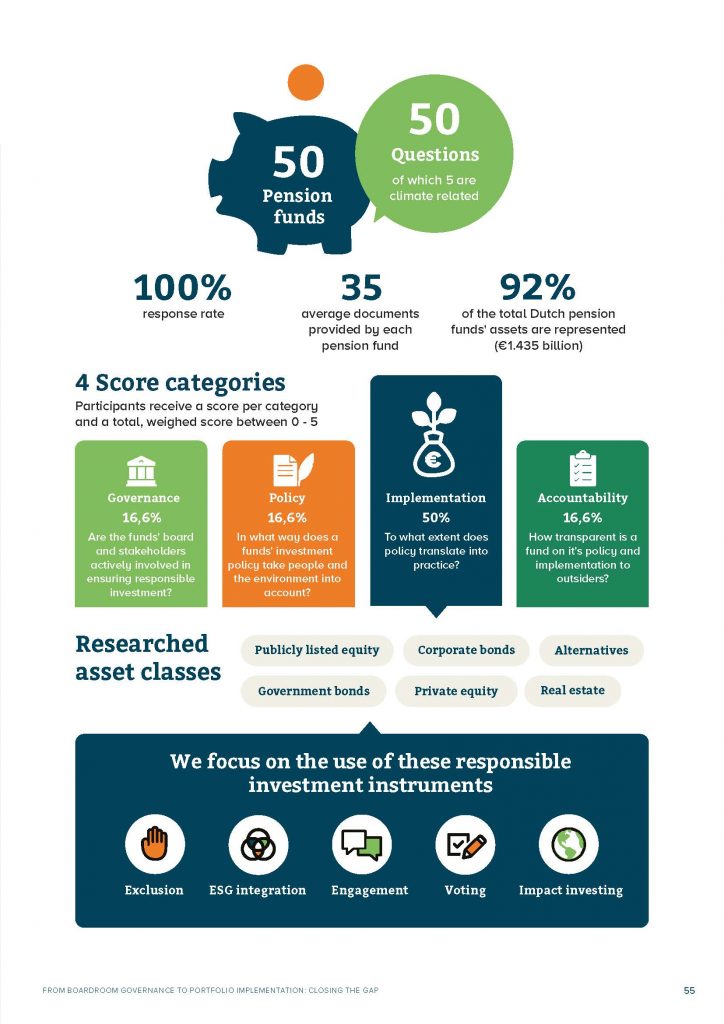

Each year, the Association of Investors for Sustainable Development (VBDO) examines the performance of the responsible investment policy of Dutch pension funds (supported by FNV). The benchmark assesses the 50 largest pension funds in the Netherlands, together accounting for 92% of the assets under management with a total value of more than € 1,435 billion. The extensive research also gives insight into the performance of the sector as a whole. This shows, among other things, that significant steps have been taken in determining policy in recent years, but there is still room for improvement translating policy into practice.

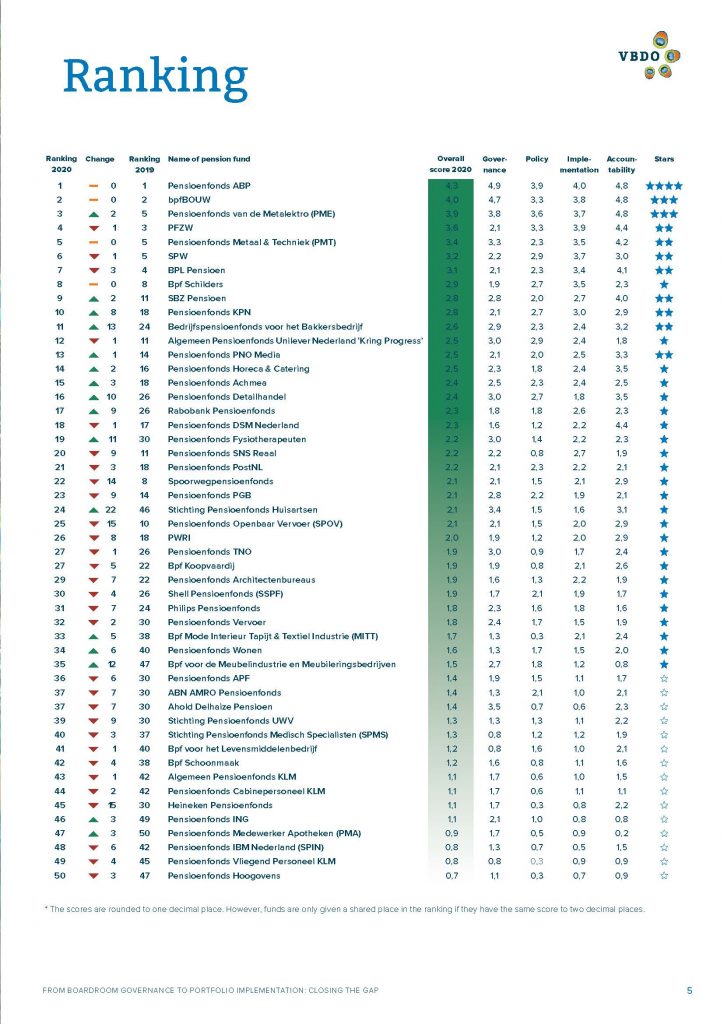

ABP Most Sustainable Dutch Pension Fund 2020

This year, ABP is again the highest scoring pension, scoring 4.3 out of a maximum of 5.

Geraldine Leegwater, ABP board member: ‘VBDO has again included challenging criteria in the benchmark this year. A benchmark that encourages action on important issues surrounding sustainable and responsible investment. ABP is very happy with the 1st place and proud that it is the third year in a row. In the new sustainable and responsible investment policy, ABP has explicitly included targets for three important transitions underway in society: climate policy, scarcity of raw materials and digitization. We see great urgency and opportunities in these areas to make our contribution to a sustainable society. And we are happy to work with science, government and other pension funds on this, and also via the benchmarks of VBDO’.

ABP is closely followed by BPF Bouw (4.0) and PME (3.9). Pensioenfonds Huisartsen rises from place 46 to 22, making it the fastest climber.

Board Member RI Knowledge Requires Attention

The vast majority of most pension funds are advised by experts in the field of responsible investment (RI). This year, questions were also asked about the level of knowledge of pension fund board members: 55% of pension fund boards have not demonstrated available knowledge on responsible investment, where only 16% has completed a full ESG course or training.

Lucienne de Bakker, project leader and researcher of the benchmark, emphasizes the importance of sufficient knowledge at board level: “Pension funds should ensure how to deal with complex social developments, such as depletion of natural resources, human rights and other geopolitical events such as the corona pandemic. Beyond their fiduciary duty, board members need to have at least a basic understanding of the different approaches and methodologies, in order to be aware of complex RI risks in their investment policies. That is a purely a matter of financial risks, apart from the negative impact on the real-world. We do see, however, that at almost a third of the funds there is someone responsible for this subject, which shows that first steps are being taken”.

Raising the Bar: New Questions

As a method of research, each fund received a detailed list with a total of 50 questions divided into 4 categories; governance, policy, implementation and accountability. In general, there has been a slow but certain increase in the average total score of the benchmark in recent years. However, this year the average score has fallen from 2.7 in 2019 to 2.1.

According to Angélique Laskewitz, executive director of VBDO, the decrease can be easily explained: ‘Benchmarks are an effective tool for stimulating sustainability improvements, because one uses the competitive strength of the market. Benchmarks create a race to the top by providing comparative insight and identifying front runners, stimulating sector-wide learning and the sharing of good practices. Fortunately, we see an upward trend in the performance of the pension funds and that top is getting closer and closer. Partly for this reason, we consult the sector and, where necessary, make changes to the questions and assessments. Every two or three years, at the request of the sector itself, we make a significant adjustment that keeps the bar high. As was the case this year, which is directly reflected in the average scores’.

The most important changes this year in particular, where the added questions about the RI knowledge of pension funds board members and questions regarding the implementation of policy. The latter were aimed at gaining clearer insight into what is happening within pension fund portfolio’s.

Laskewitz explains: “Because we have a better insight into the implementation of government and policy this year, a different picture emerges than the image we might have had in recent years. That being said, we must not forget that the sector as a whole takes takes steps every consecutive year that, fortunately, show a positive line of sustainable development where it comes to responsible investing’.

A Structurally Sustainable Policy

A remarkable notion is that all participating pension funds have long included so-called ESG factors in their investment beliefs, which means that when investing, they endorse the importance of matters such as good governance and the impact of investments on people and the environment. In addition, all pension funds make use of the deliberate exclusion of certain companies and sectors in their investment strategy that are characterized as harmful to people or the environment, such as tobacco or arms trade.

Finally, more than 4 out of 5 funds can demonstrate that they make use of ESG integration within the policy of their equity portfolio and formulate objectives that demonstrate an increased ambition in sustainable investment.

The Gap Between Policy and Portfolio

There are a few caveats to this. For example, only 10% of pension funds include a clear step-by-step plan with time-bound and measurable goals in the translation to their portfolio. Just under 2% not only sets measurable objectives for the composition of their own investment portfolio, but also takes into account the impact of the investments made on people and the environment in practice. In addition to using exclusion as an investment strategy, pension funds do not yet keep track of the possible negative impact of their investments.

The research also shows that only a small number of pension funds require their asset managers to operate in line with the fund’s objectives. As a result, the ESG policy of the equity portfolio is only applied to a little over 50% of final investments. Almost half (44%) of the pension fund portfolios are still insufficiently in line with the funds’ responsible investment policy.

Edith Maat, director of the Pension Funds Federation: ‘We see that the bar in this benchmark is raised each year. This year, questions on new subjects have been added. Where policy formulation appears to be in order for most funds, it is now important to demonstrate how policy has been and is being implemented. The measurement methods that have been developed for this are being further developed and are increasingly used. It is a good thing that these methods are being used at European level, as on better data – and that external effects such as environmental damage are starting to play a part in pricing. The Dutch pension sector makes an active contribution to this, because it further improves the implementation of responsible investment. We expect to see another step forward next year’.

Future Perspective

Laskewitz thinks and sees that Dutch pension funds are willing to invest responsibly. ‘We have seen for years that funds are investing more and more responsibly. We’ve been talking here about percentages and numbers of pension funds. But if you look at what those number mean for the total of assets under management, the Dutch funds are actually already doing quite well. However, as one can also conclude from our research, we do see a discrepancy between policy and practice’. Her advice: ‘We’ve noticed that at board level, there’s room for attention concerning RI-knowledge. In the meantime, funds can make sure there is sufficient counterweight offered by management. Increase the diversity of the management board and the investment committee and thus increase the knowledge about responsible investment. Finally, formally establish relevant responsibilities in the board’.

Top 50 Most Sustainable Dutch Pension Funds 2020

Benchmark presentation

The benchmark was presented during a Financial Investigator live cast event on the 26th of October 2020. You can revisit the presentation here.

Benchmark Methodology