What is sustainable investment?

Sustainable investment is becoming more and more mainstream. But what exactly does this form of investing mean?

Instruments

When institutional or private investors want to become more sustainable, they have a number of instruments at their disposal. The most important of these are detailed below:

Exclusion

Investors can exclude companies and activities that they find controversial. Companies can be excluded on the basis of products they make, such as weapons, or because of the production process or the supply chain, such as when a company uses child labour. In addition to individual companies and sectors, countries can also be excluded.

Positive selection

In the case of positive selection or the ‘best-in-class method’, investments are only made in companies that score highly on sustainability criteria within their sector.

ESG integration

ESG stands for environmental, social and governance. ESG integration means that relevant criteria relating to these areas are taken into account in the investment decision.

Voting

Active shareholders can exercise their voting rights at shareholders’ meetings. A sustainable shareholder takes ESG criteria into consideration when voting for or against a proposal. The shareholder can also initiate a proposal themselves.

Engagement

A shareholder or bondholder of a company can start a dialogue about the sustainability performance of the company in question. This type of dialogue is called engagement.

Impact investing

Impact investments are investments that have been made with the intention of generating positive social and environmental impacts. Examples include investments in clean energy, education and microfinance.

Types of investing

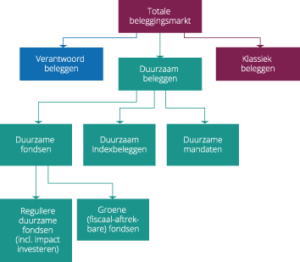

Total investment market

- Classical investing

- Responsible investing

- Sustainable investing

Sustainable investing

- Sustainable funds (regular/ green )

- Sustainable index investing

- Sustainable mandates

Classical investing

With classical investing, the primary focus is on financial results. Classical funds meet minimum legal requirements in the field of sustainability, such as the exclusion of cluster munitions.

Responsible investing

In addition to legal obligations, responsible funds avoid the most controversial activities, such as those that violate the UN Global Compact principles. An instrument like engagement is often used. ESG criteria can have a weighting in investment decisions, but are usually not given precedence.

Sustainable investing

With sustainable investing, a fund systematically uses one or more instruments to promote sustainable business operations. For example, a fund may choose to solely invest in more sustainable companies. ESG criteria have a major weighting in investment decisions. A sustainable fund acts as an active owner and addresses sustainability on a structural and frequent basis. The investment philosophy and documentation provide a transparent and clear picture of how the fund implements sustainability and what effects it intends to make. The application of instruments is described and the report references the sustainability instruments used and sustainability performance.

Sustainable funds

Sustainable funds can be divided into regular sustainable funds and tax deductible funds:

– Regular sustainable funds (including impact investing)

Regular sustainable funds are investment funds that meet the characteristics of sustainable investment, as described above. Impact funds focus specifically on demonstrably achieving environmental and/or social change. Impact investments are mostly in projects and companies that are not listed on the stock exchange.

– Green (tax-deductible) funds

Green investments are investments in funds that participate in environmental projects. These green investments enjoy tax exemption in the Netherlands.

Sustainable index investing

Increasing attention is being paid to sustainability in index investing: shares are spread out in a basket of shares whose returns are on par with those of the stock market as a whole.

Sustainable mandates

A management mandate is when the client sets a framework in which the managing institution has the authority to make investment decisions. A sustainable management mandate requires the manager to only purchase sustainable funds and titles.